How to Minimize the Effects of Renewable Curtailment and Cannibalization

In our latest blog article, our CAMOPO Energy Market Analyst Alper Peker shares valuable insights and proven strategies on how to minimize the effects of renewable curtailments and cannibalization. Learn which role hybrid power plants play and how to successfully implement strategies to thrive in an energy landscape with high renewable shares.

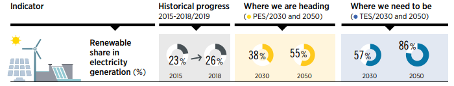

In line with global CO2 reduction targets, renewable energy penetration is increasing on a global scale, thanks to continuously decreasing levelized costs of production and phasing out of conventional generation assets. IRENA projects 38% of renewable share in electricity production by 2030 versus 23% in 2015. To achieve global climate goals, this needs to further accelerate.

Based on IRENA scenarios (PES and TES), along with Spiegel (2020), IEA (2019a, 2019b), IEA and IRENA (2017) and IRENA (2019a) for 2015-2018 historical progress.

Yet, renewables come with their own challenge, namely their weather-dependent and non-dispatchable generation characteristics. A renewable asset performs similar to other assets with the same technology in the same region. If the wind blows, all wind assets perform and if the sun shines, all solar assets produce. This eventually connects to the simple supply-demand phenomenon, if supply is way too much, the offered product is valued less. This applies to renewable energy generation too, resulting in higher prices during scarcity and lower (even negative) prices during abundance. In addition to that, some portion of renewable generation can be curtailed, to relieve the grid and secure grid stability.

In the past, the limited penetration of renewables did not cause much concern for grid operators since their volatile generation pattern could be managed and offset by conventional assets. Also, from the financial perspective, most of the renewable generation was remunerated with constant support scheme tariffs, which let them be detached from spot market price developments. In today’s world, renewables started to be the main actor of generation mix in many regions. Moreover, they are not all immune to market price exposure due to gradual removal of support schemes. These conditions revealed a phenomenon called market cannibalization, which can be defined as “…energy technologies such as solar and wind generate simultaneously and depress the wholesale electricity price.” (Source: Pexapark: The Effect of Cannibalization).

CAMOPO

In this respect, we believe that hybrid plants (renewables bundled with storage assets) are the primary mitigants to overcome curtailment and cannibalization. Let’s elaborate this a bit more with a wider perspective.

The renewables of today are being pressed from various courses . The first one being the grid operators, who regulate (mostly reduce) the generation of these assets to protect the grid, which may from time to time cause generation curtailment and the second one being the mighty and merciless market, which pushes prices down during abundance of renewable generation, and hence the revenues of increasing number of renewable assets. The last but not the least, the governmental support schemes tend to discontinue compensation of renewable assets during curtailments, since they are now part of daily routine.

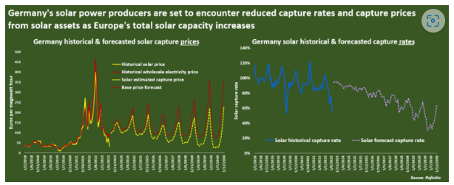

This shift did not happen overnight. Yet, it is already there and will not speed down soon. A projection of German market capture rates (a metric showing to what extent the renewable production captures the daily baseload value) below would give an indication:

Source: Reuters

As can be seen above, in the upcoming years, the “value” of solar generation in Germany is expected to deviate more and more from market prices in a negative way. The severity and timing of this trend would be different in other parts of the globe. Yet, it should be acknowledged that this is a global phenomenon either way.

The mitigants and remedies to minimize the impact of cannibalization and curtailment are relatively new. Yet, various approaches are being developed in the market. Below, we want to share some of them, which we find noteworthy:

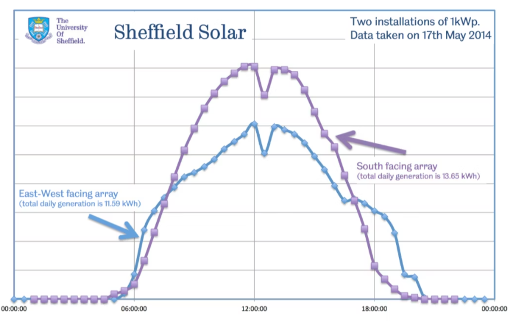

- Work Smart Not Hard: Previously solar projects aimed for the maximum yearly generation within a given location. This, for instance motivated developers in northern hemisphere to install solar panels directed at South, if there were no other geographical constraints. Although south orientation enables maximum generation amount, it is very much concentrated at noon hours. Since the market prices have increasingly been low/negative during noon hours (particularly in sunny season), there is a current trend of installing the solar panels in East-West direction.

Source: The University of Sheffield

As can be seen from above exemplary graphic, South facing panels generate more in daily total, thanks to noon hours, whereas East-West facing panels generate less in daily total but more during morning and evening hours. It is common experience that, demand is usually higher at morning and evening hours, which pushes electricity prices up. In this respect, the East-West panels may benefit from these higher prices at the expense of less generation volume.

- Avoiding Traffic: Everyone hates traffic. Electrons too. Although electricity grid is considered as a single and uniform web for simplicity reasons its capacity is not uniformly distributed. This means, some regions and interconnections are more prone to congestion and bottlenecks compared to others. To make it more complicated, this may change continuously as per the variations in demand and generation availability. It is the duty of transmission and distribution operators to secure the well-being of the grid, sometimes at the expense of curtailing renewable production. Due to increasing curtailments, developers tend to choose their project location, where the grid congestion is less likely to emerge.

- Location, Location, Location: In addition to regional differences with respect to grid resilience, another topic of discussion is the adaptation of zonal/nodal pricing, which can be defined as the non-uniformity of prices within a country. Under zonal pricing, electricity prices may differ in each defined zone, whereas in nodal pricing, prices may even differ at each defined node. What makes the prices vary is the local dynamics of demand, supply, grid resilience and transmission cost between zones/nodes. Zonal/nodal pricing is not a brand-new concept, and it is already being used in many markets (US, Australia, Nordics, etc.). What is new is the discussion and assessment in many other countries (UK, Germany, etc.) to adapt it or not. Although, there are still some concerns around that, it seems more likely that we will be seeing more examples of zonal/nodal pricing before the end of this decade. This possibility brings another dimension to a renewable developers’ project assessment process, since they would tend to build their project in regions where demand is higher, and production is lower. This may be again a sacrifice of generation maximization, however, may end-up with better financial rentability. What you often hear from your real-estate expert is in that sense applicable for energy market as well.

- Survival of the Fittest: In nature, hybrid breeds have more chance to endure, compared to pure ones. This holds for energy investments too. One of the most popular mitigants of curtailment and cannibalization is adding batteries (maybe even electrolyzers) to renewable assets, not only for new projects, but also for existing ones, namely “hybridizing” them. It is a sensible and proven way of avoiding unused renewable power and for getting the maximum of renewable asset. The fundamental challenge here is two-sided. First one is the decision of battery power output and capacity. Although, battery costs are at a good declining trend, they are still a considerable cost item. It is therefore crucial to be able to find the “sweet spot” where the addition of battery would bring the best return. Second one is the optimization of the hybrid asset. Even with the optimal sized battery, if the daily operation is not properly managed and various revenue streams (generation shifting, wholesale market trade, ancillary services, etc.) are not properly utilized, the expected benefit of hybridization would fall behind.

- Be Ready to Stabilize the Grid: Phasing out of conventional generation assets bring new challenges to grid operators, particularly from a technical point of view. In the past, conventional assets and machines would be used to sustain grid strength, stability, and resilience. These responsibilities are recently being taken over by renewables and batteries. Although this is rather a newly emerging topic (and newly being consulted in regulatory area), in the near future we will be seeing more and more renewables contributing to grid stability. This would have a positive impact for better utilization of these renewable assets (avoiding curtailment and cannibalization), facilitating a new revenue stream. The prerequisite for such option is surely designing and building the renewable asset system with required technical capabilities, not only for today’s but also for future’s grid requirements.

Conclusion

Increased curtailment and cannibalization of renewables are unavoidable consequences of increased renewable penetration. Having said that, with proper due-diligence and good selection of solution partners, renewable developers and owners can beat the competition and secure the best return for their investments.

As CAMOPO, we are ready to support you starting from the very beginning of your hybrid project, as well its whole operational life. Please feel free to contact us by sending an E-Mail to info@camopo.com and we will get back to you shortly thereafter.